The Efficiency Paradox

A prevailing hypothesis in modern organizational theory suggests that companies prioritizing extreme cost-efficiency and rigid balance sheet controls often struggle to adopt Artificial Intelligence effectively.

We often assume that a “tight ship” is a well-run ship. However, when it comes to AI adoption, the “Efficiency Defender”—an organization prioritizing immediate Net Income protection and rigid annual budgeting—often lacks the financial agility required for innovation. Conversely, the “AI Innovator” accepts higher initial Operating Expenses (OPEX) to drive exponential future value.

Recent analysis suggests that companies with rigid “Annual Lock” budgets are 60% less likely to scale AI projects beyond the pilot phase compared to those with venture-style internal funding.

Here is a breakdown of the patterns between organizational AI maturity and year-end balance sheets.

1. Efficiency vs. Adoption: The Negative Correlation

There is a noticeable pattern when comparing an organization’s Operating Expense Ratio (willingness to spend) against their AI Maturity Score.

The Insight: Organizations hovering in the “Safe Zone” (high short-term efficiency, low spending) often score significantly lower on AI maturity. This is due to a lack of R&D liquidity. To move up the maturity curve, organizations must be willing to sacrifice short-term margin efficiency for long-term capability building.

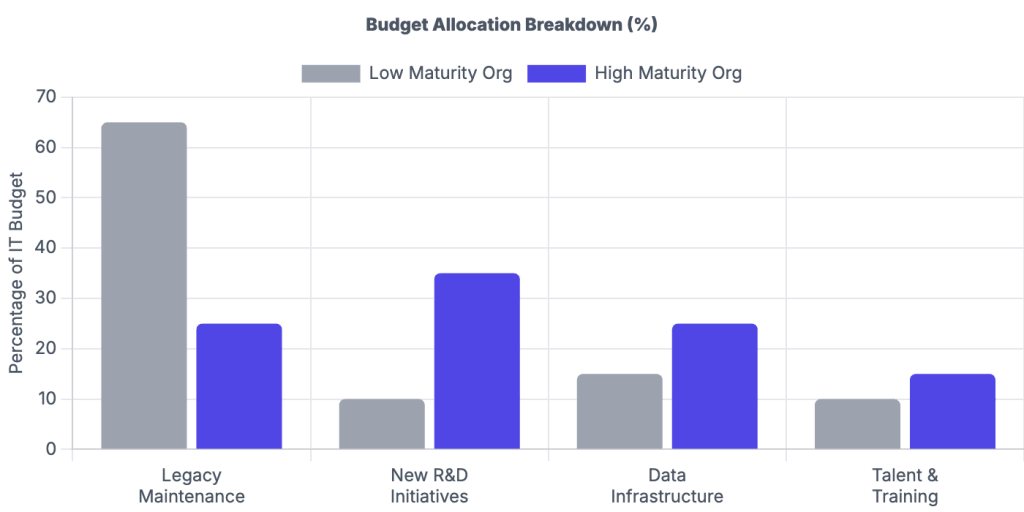

2. Where Does the Money Go? (Budget Allocation)

The clearest differentiator between low and high-maturity organizations is not how much they spend, but what they spend it on.

The “Keep the Lights On” Trap (Low Maturity)

In traditional organizations, up to 80% of the IT budget is consumed by maintenance (Legacy Maintenance) and licensing. AI is treated as a “Project” requiring special approval, often rejected due to uncertain immediate ROI.

The “R&D” Shift (High Maturity)

Mature organizations compress maintenance costs via automation. Capital is reallocated to:

- New R&D Initiatives: Testing hypotheses.

- Data Infrastructure: Viewing data as an asset, not a storage cost.

- Talent: Hiring engineers, not just administrators.

3. The Decision Loop: Rigid vs. Agile

Why do efficient companies fail at AI? It often comes down to the process flow of capital allocation.

- The Rigid Loop: Starts with an Annual Budget Lock. Proposals require guaranteed 12-month ROI. Because AI is experimental, it gets flagged as “High Risk” and rejected, leading to stagnation.

- The Agile Loop: Utilizes “Adaptive Funding” buckets. Teams are encouraged to “Pilot & Fail Fast.” Successful pilots receive scaled funding immediately, leading to compound value generation.

4. The Shift: CAPEX to OPEX

Traditional organizations love CAPEX (Capital Expenditures)—buying servers and depreciating them over 5 years creates a predictable tax shield. AI Maturity, however, correlates with a massive shift to OPEX (Operating Expenses).

AI-first firms rely on Cloud compute, API tokens, and “AI as a Service” models. On a traditional P&L, this looks “expensive” because it hits the operating margin immediately. However, this structure offers superior scalability. The “High Maturity” growth curve typically shows an initial dip (the investment phase) followed by exponential returns that traditional linear models cannot catch.

5. Innovation Impact Analysis

Finally, where is the “Sweet Spot”?

When we plot companies based on R&D Spend % and Net Margin, we see that high-efficiency (high margin) companies often have small “AI Maturity” footprints. They are optimizing for today’s profits at the expense of tomorrow’s relevance.

The most mature organizations occupy the middle ground: they accept moderate margins in exchange for high R&D spending, positioning themselves for dominance in the AI era.

Conclusion

For the day-treader or investor analyzing organizational health, a “perfect” balance sheet with minimal expenses might be a red flag in the age of AI. Look for organizations that are actively restructuring their P&L to accommodate the shift from legacy maintenance to agile innovation.

This article was written with the assistance of my brain, Google Gemini, ChatGPT, Claude, and other wondorous toys.